- Factor Capital

- Posts

- Year End Update, Markets, Plumbing, and the 2026 Setup

Year End Update, Markets, Plumbing, and the 2026 Setup

If you have been following the monthly notes, you have seen the direction of travel all year. 2025 was the year crypto stopped needing to be defended in every conversation. Regulation moved from hostile to actively supportive. Corporate and institutional buyers showed up in a way that felt durable. The loudest narratives shifted away from ideology toward utility.

That should feel like a clean setup for investing. But instead it feels like the investment landscape still feels shaky in traditional terms.

Things are working. Adoption is real. The problem is that the parts working best are also getting easier to copy, and a lot of what is getting funded assumes scarcity that is already disappearing. It is very easy to confuse momentum with durability right now.

Year in Review

The clearest story of 2025 was the continued maturation of stablecoin rails and tokenized settlement. Stablecoins keep winning for the same reason they won in 2024. They let people move dollars globally with less friction than banks, and they let businesses reduce cost and complexity in payments, treasury, and cross border workflows.

Tokenization sits on top of that. When you can represent value digitally and settle it programmatically, a lot of the back office stops being a moat and starts looking like a tax. Compliance and reporting still matter, but the shape of the work changes. It becomes software and automation, not a growing headcount of people reconciling systems that were never designed to talk to each other.

You can see this across our portfolio. Dinari and Plural are good examples of the direction institutional tokenization has to go, regulated, compliant, and built to survive contact with the real world. Shield is a good example of the opposite end of the spectrum, stablecoin rails winning because exporters and merchants need speed and reliability, not because anyone cares about a token narrative. Coala Pay sits in the same practical category, where stablecoins are simply the best way to move funds into difficult places with fewer failure points.

This is the “mundane” arc of crypto that I keep coming back to. It is not headline grabbing, but it compounds.

There is a second order effect here that I think most people still miss.

A lot of the most valuable on chain activity is not expensive in terms of blockspace - essentially bandwidth on blockchains. It does not create priority settlement bidding wars the way trading does. Billions of dollars in stablecoin payments can be handled with relatively little strain on a modern chain because these are simple transactions and most of them do not care about being included in the next block.

Trading is different. If you are arbitraging, liquidating, chasing memecoin volatility, or doing anything where being first matters, you pay for priority. People compete for inclusion. Fees rise. You see real demand pressure on blockspace and that is when the underlying chain token tends to capture value.

Payments and boring asset settlement do not behave like that. They can be huge in notional dollars and still be light in actual blockspace. They are throughput friendly and price sensitive. They route to whatever is cheap and reliable. They do not naturally push fees up. They do not naturally create scarcity.

That is why you can see on chain adoption rise and still not see ETH or SOL re rate the way people assume it should. In a world where the dominant growth category is price sensitive utility, the base layer starts to look like commodity plumbing. The value accrues to the businesses built on top of the rails, not necessarily to the rails themselves.

This is not a bearish take on crypto adoption. It is simply a reminder that useful activity and token price appreciation are not the same thing. Just look at Tether - a business with no speculative token that is now reportedly valued at $500B in private markets. With close to $200B in USDT stablecoins now in circulation, it is worth more than Solana and Ethereum combined and makes more than $10B in profit annually on just the interest from the underlying assets it holds backing USDT.

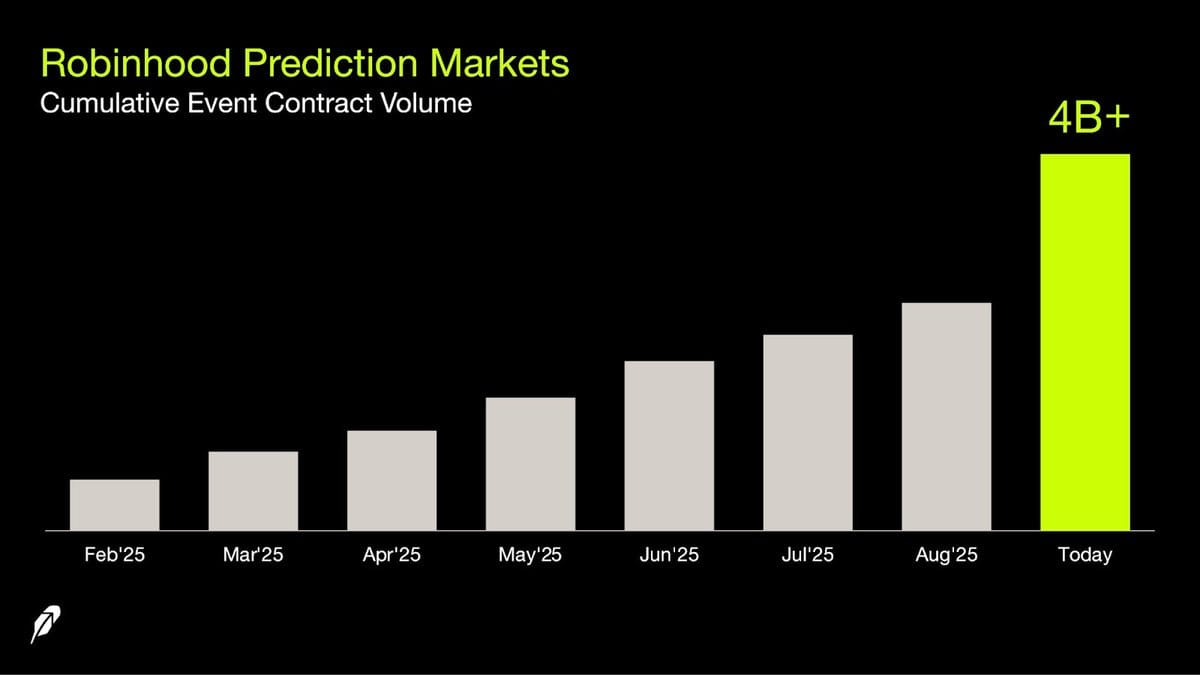

Prediction Markets Finally Crossed the Threshold

The other theme that became hard to ignore this year was prediction markets. People have talked about them for a long time. The concept always made sense. The issue was that they were rarely good products.

Earlier versions had the same problems again and again. Liquidity was thin, so prices were noisy and spreads were wide. Fees and friction made active participation irrational. Settlement and resolution were messy, which created trust issues. Access was clunky. Users had to learn new tooling and accept workflows that felt experimental.

Crypto makes prediction markets work now because the stack has matured enough to remove those points of friction.

Stablecoins solve the collateral problem. People can use a predictable unit of account, and the experience feels more like a market and less like a crypto exercise. Cheaper rails make frequent trading viable, and frequent trading is what makes prices informative. Smart contracts can handle settlement in a way that feels consistent, which matters because nothing kills a market faster than uncertainty about getting paid. Resolution mechanisms have also improved, partly because operators have learned through mistakes and partly because users have become more sophisticated about how disputes get handled.

Distribution improved at the same time. Markets now reach users through the apps and channels people already use, which helps pull liquidity into the right places. Liquidity then improves the product, and the flywheel starts.

@vladtenev - Sept 29, 2025

The more interesting part is that prediction markets are moving beyond politics and novelty into categories where credible data becomes a real asset. And it isn’t just sports markets. Parcl is a good example here. Their partnership with Polymarket to launch real estate prediction markets powered by Parcl’s housing price indices turns their daily pricing data into something tradable and visible. It also puts Parcl in a different position in the stack. They stop being only a DeFi primitive and start being a source of truth that can travel into broader consumer distribution.

That is the pattern to watch. Prediction markets get compelling when you pair credible data with a liquid venue, and when the venue is fast enough and familiar enough that normal users participate.

The Constraint Within Success

The practical turn in crypto creates its own constraint. For most of the last decade, the industry’s gravity came from token appreciation. That dynamic created generational outcomes for early adopters. It also created the casino culture that still dominates a lot of the attention.

Functional adoption does not automatically translate into high margin value capture for underlying tokens. Usage can rise quickly while token prices drift or decline when adoption is happening through stablecoins, settlement plumbing, and enterprise workflows that do not require speculative upside.

This also changes the investing landscape. Mainstream adoption makes the space accessible to a wider set of investors and operators. Crypto native expertise still matters, but it compresses in value. It becomes closer to table stakes. Early stage investing gets more competitive, pricing gets tougher, and the cost of being wrong increases.

The Timing Problem

The bigger issue, and the one that applies to both crypto and AI, is timing.

We are almost certainly living through the canonical “Webvan” style moment I wrote about last month. Webvan was directionally right about grocery delivery in the initial dot-com era. The model worked. The arc played out. But they built the required infrastructure too early and too expensively, and later entrants built similar outcomes on dramatically cheaper smartphone and GPS rails.

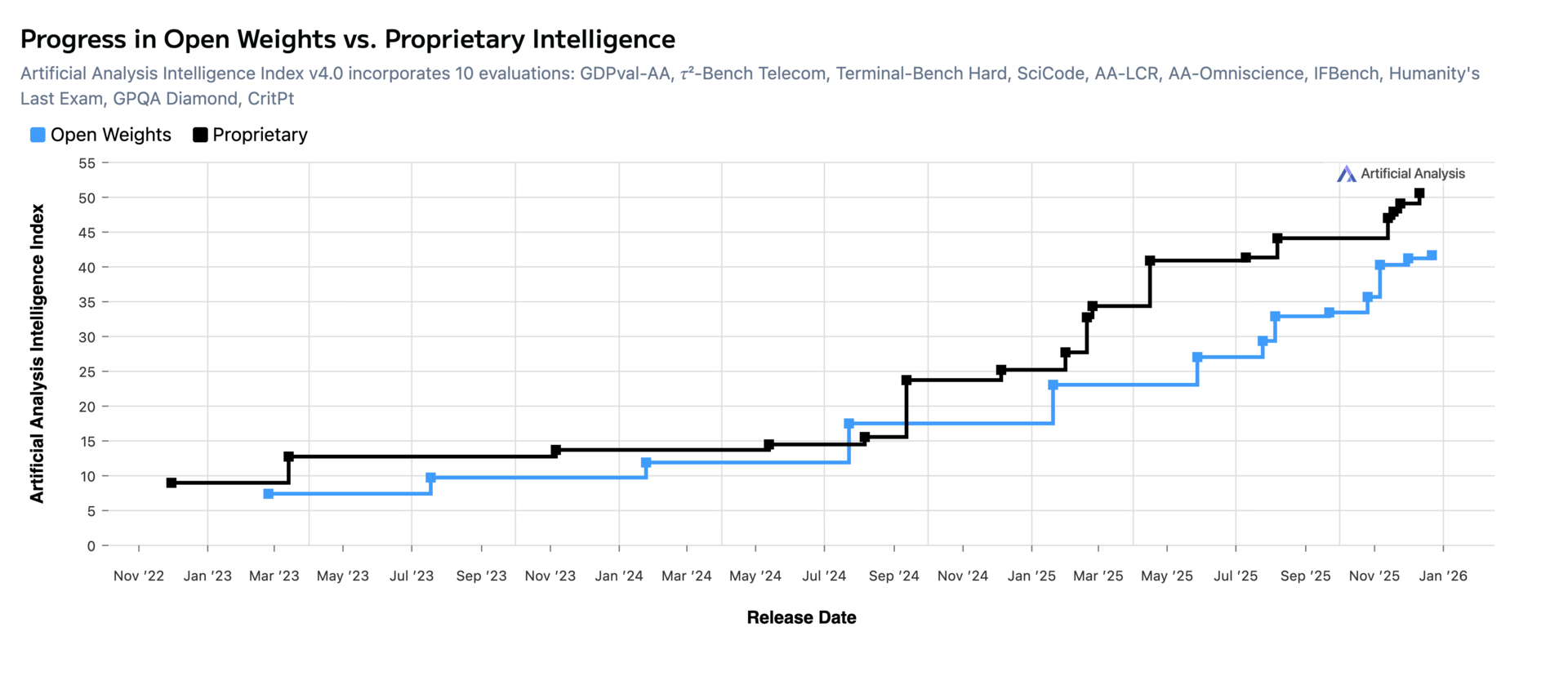

The same dynamic is unfolding now. We are moving toward a world where models and intelligence that feel scarce today become local, cheap, and widely available. In 2026, we will have multiple models that exceed the performance of today's frontier models (which are already incredible) able to run locally on your phone or laptop. Inference running on phones and laptops changes product economics and changes moats. It accelerates adoption, and it also compresses differentiation.

Open source models are closing the gap

This is one reason edge oriented infrastructure matters. If intelligence and decision making move closer to where data is generated, the companies building those rails are positioned well. 375ai is a direct expression of this direction, edge data intelligence infrastructure built for real world deployment, not just demos. The real edge of 375ai is that they are working at the edge to collect proprietary data that's not just "web data" that everyone has access to. they can curate the data collection responsively with crypto-based coordination of incentives and increasingly powerful edge compute capabilities for on device image processing, etc.

The investor mistake I see most often is underwriting a cost structure and a defensibility story that assumes the current stack stays scarce. It will not.

AI Has the Same Problem, But Worse

AI is in a similar place, with even more pressure on moats.

We are already seeing consolidation. Teams that need distribution and compute find it rational to join platforms that can provide both. Just look at the deals of the past two weeks. Two of the hottest private AI companies, Manus for agentic workflows and Groq for inference chips, were both scooped up by Meta and Nvidia respectively for billions of dollars. For founders, employees, and investors, the outcomes can be great. The economics for these upstarts also improve quickly when compute stops being a constant capital drain and becomes something you effectively inherit.

The question for 2026 is where durable value capture sits once capabilities spread. Demand for AI will be extraordinary. Most businesses will be rewritten around an intelligence layer. Workflows, software interfaces, and back ends will reorganize around models in the same way the internet reorganized software around connectivity. Just this week at CES, Jensen Huang stated that the world is in the midst of a $10 trillion infrastructure replacement cycle, where traditional data centers are being modernized into "AI factories" powered by accelerated computing. He argued that this shift is essential to move from an era of programmed software to a generative era where trillion-parameter models drive every industry.

To be clear - I absolutely think that most of society still underestimates the magnitude of AI’s everyday usefulness and how much productivity we are on the verge of unleashing. There is a reason why every conversation today somehow shifts in its direction.

The risk is that a meaningful number of fast growing AI businesses are selling something that will be commoditized. When the underlying model capability becomes cheaper and more local, churn can rise quickly and differentiation can disappear faster than the company can reposition. I suspect that several of this era’s current hot startups will be overwhelmed by their capital stack when they have to spend millions of dollars today to build products that will cost a fraction of their current costs in the next couple of years.

This is where crypto can feel oddly ahead. Tokenization and stablecoin businesses have had years to grind toward sustainable unit economics in hostile conditions. A lot of AI businesses are still learning what durability looks like once the novelty wears off.

What This Means for Builders and Buyers

At Factor, the clearest signal this year has been that application layer bets hold up best when they align with obvious buyer urgency and measurable outcomes. Tokenization oriented businesses have largely performed well. When companies struggled, it tended to come from externalities that invalidated a market or from a slower path to product market fit.

We saw externalities in energy. Policy shifts around renewable energy incentives damaged parts of the market that our portfolio companies like Jasmine and Neutral were reliant upon and they and many of their peers and competitors were crushed. Despite their tireless efforts and strong execution, you don’t always have time to pivot when the substrate changes.

On the product market fit side, buyer psychology matters more than most founders want to admit. Buyer attention is concentrated around strategic priorities, and AI has dominated that attention. If you sell something valuable but it is not what the buyer wants to champion internally, deals slow down.

The companies that keep moving are the ones offering clear leverage with defensible ROI. Crunch has benefited from the reality that enterprises still have scarce data science capacity and need it applied quickly. Jolly has benefited from offering measurable improvements to retention and performance, delivered with discipline and strong unit economics. This is a reminder that AI leverage is often simple. It looks like outcomes that a buyer can defend in a budget meeting.

The Coming Shakeout

I think we are nearing a shakeout in both AI and crypto markets.

In crypto, asset performance will likely remain bifurcated. Businesses leaning into corporate and institutional demand should outperform those built purely for the culture that defined the earlier era. There will be tension, but this is a common pattern. The rebels become the establishment, and the thing that felt subversive becomes simply part of a supply chain.

Where I land heading into 2026 is straightforward.

The builders with the most leverage right now are often not the ones trying to invent new categories. They are the ones turning cheap intelligence into direct distribution, conversion, or operational advantage at near zero marginal cost.

If you sell a clothing line or a device, the person who realizes they can generate custom content on demand, ad creative, product explainers, spokesperson style videos, even a model tailored to specific demographics, effectively for free, has a clear path to ROI. The technology becomes a direct input to customer acquisition.

The same is true for regional, ordinary, boring businesses that discover they can produce a custom vertical software solution that fits their workflows and displace a legacy incumbent with a few weeks of focused work. In many cases, that is a cleaner risk reward than trying to create a new category.

The home runs will still happen, and the outcomes will still be enormous. The skew right now feels toward the clear advantages, applied quickly, on cheap infrastructure.

The economy is being rewritten through markets and plumbing, and 2026 is when the setup starts getting tested.

Thanks as always for reading and Happy New Year.

-Jake

Jake Dwyer

Founder & Managing Partner

Factor Capital