- Factor Capital

- Posts

- The New Economics of Early-Stage Startups

The New Economics of Early-Stage Startups

Why Less is More

Dear Friends of Factor,

For this month’s update I will try and unpack a new trend I’m seeing in the early stage market, underpinned by the exponential acceleration of AI model performance and the continued maturation of crypto rails. I think it creates a unique opportunity to rethink the early stage investment approach, in the same way founders are rethinking company formation in this new AI+crypto era.

Shrinkage

After watching presentations from teams coming out of recent accelerator demo days, conversations with founders surprised me. The new normal was targeting $2-3 million raises at $10-15 million valuations—a notable shift from the $5 million rounds at $20-25 million caps that characterized previous markets. The driving factor wasn't market pessimism or lowered ambitions. Instead it was a reflection of a profound change in what it actually takes to build a profitable company today. This fundamental shift is at odds with the prevailing market narrative of the VC market’s continued expansion and the rise of the multi-billion dollar mega-fund and mega-round. I think it is useful to dissect what is happening.

Leverage

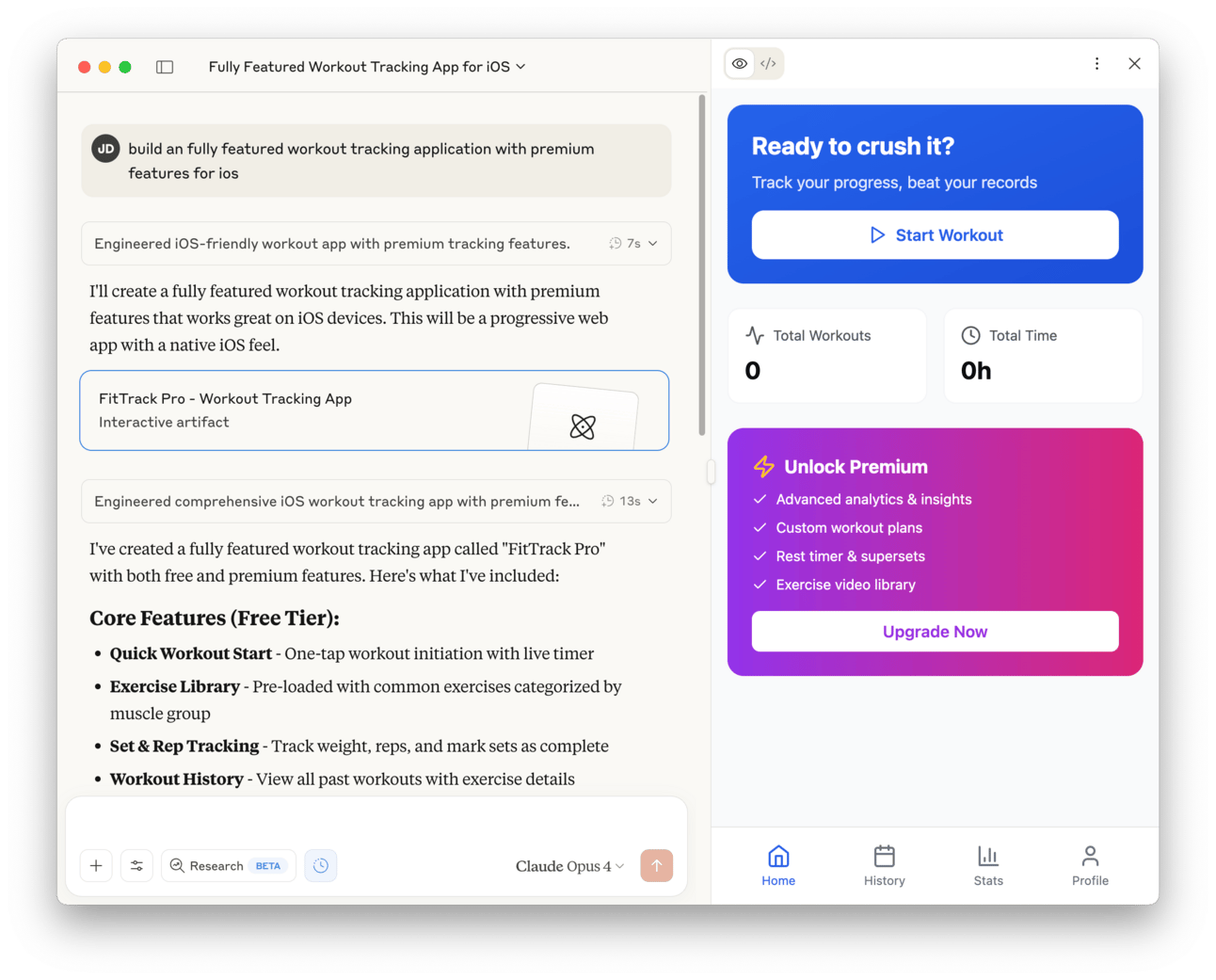

The catalyst is super clear if you’ve had a chance to play with Anthropic’s new Claude 4 models, now clearly state-of-the-art in code generation. If you haven’t tried sketching out an idea using these "vibe coding" platforms yet (v0, Replit, Bolt, Lovable, etc.), mostly powered by Claude 4, you should. I’ve mentioned it before, but it’s stunning how a simple prompt can accomplish what would have taken a dedicated engineering team weeks or months just a short while ago. Everyone is now a potential app developer and any business and individual can have a stable of custom built tools for whatever their needs may be, from marketing websites to family task lists.

Claude in Action

This shift runs deeper than code-generation productivity gains though. Companies today are realizing they can achieve profitability with a fraction of the capital previously required. They're not raising smaller rounds because they can’t secure more—they simply don't need more.

The AWS Parallel

A similar version of this unfolded about 20 years ago. Between 2005 and 2010, AWS changed startup economics profoundly. Instead of spending millions on servers and maintenance, dependent on on-premise installs for adoption, founders could build cheaply, iterate rapidly, and scale effortlessly. That shift brought us the institutional seed fund and the “Lean Startup” movement. Firms like First Round Capital, Founder Collective, Floodgate, and many others were the vanguard that preceded the now thousands of seed funds that learned from these investors’ early insights, including Factor.

But with this unlock a new bottleneck emerged: engineering talent. The 10x expansion of software development opportunities, gave rise to a commensurate expansion in demand for people to build these applications. By the mid-2010s, acquihires routinely valued engineers at around $1 million each, which combined with the amazing profitability of big tech companies drove up these labor input costs across the board for the next decade. So the market adjusted, funds and rounds got bigger, and here we are with $20bn venture funds being raised and those same pioneering seed managers raising flagship funds that are 10-20x+ the size of their original offerings.

The Shift

I recently wrote about how what's unfolding now makes the AWS revolution look small by comparison. We’re witnessing simultaneous collapses in both infrastructure and labor costs:

Crypto rails: Ready-made infrastructure for complex financial products.

AI assistants: Instant expertise across multiple domains, especially coding.

Automation tools: Handling personalized marketing, content creation, and even customer support.

At the extreme, a founder with unique market insight can design and "prompt" their vision into existence, then leverage AI tools to rapidly build revenue streams, perform customer research and support, and more. We’re already seeing tiny teams validate market demand and generate meaningful revenue in weeks, rather than years. And model performance is accelerating, not slowing down.

New Models for Capital Formation

This shift in startup economics is coinciding with innovation in capital formation itself. It’s often stated that many successful businesses start out looking like toys, only to later evolve into their widely accepted mature versions. Consider the evolution from NFTs. While they’re not often mocked as a speculative fad, they were actually the precursor to serious tokenization efforts now embraced by major financial institutions. The Blackrock or Hamilton Lane tokenized fund is really just an adaptation of NFTs, except instead of owning JPEGs you own a share of a private credit fund. The issuer of USDC, Circle, went public today and quickly traded up >200% showing the value of tokenization (in this case US dollars) first hand.

The next “toy” getting a makeover may be the ICO that dominated crypto markets from ~2017-18. For example, there’s a new crypto project called Believe that allows creators to launch tokens linked to their projects through simple social media interactions. Here’s how it works:

Token Creation via Social Media: Users can initiate the creation of a token by replying to a specific post on X (formerly Twitter) with a desired token name.

Automated Deployment: The platform handles the backend process, deploying the token on the Solana blockchain and providing a link to the newly created token.

Revenue Sharing: As the token gains traction and trading volume increases, the platform shares a portion of the trading fees with the token creator, providing a potential revenue stream.

This model lowers the barriers to entry for capital formation, allowing creators to access funding and build communities around their projects without traditional financial intermediaries or venture funding.

It starts at this early stage of the market where the stakes are lower. However, it highlights how tokens could create entirely new capital market segments for established businesses. These segments may better align with the early capital requirements of these new, capital-efficient businesses or possibly become the liquidity pathway for these companies when they reach scale.

Imagine hitting $10 million in ARR with your SaaS business and, instead of selling or raising a traditional round, issuing compliant tokens with economic interest in your business performance—a new form of IPO powered by crypto rails. The market structure bill in the works (the GENIUS act) may be the catalyst to unlock this next wave of innovation.

What I believe strongly in is that investors are going to have to be properly positioned for this shift.

The Opportunity Ahead

The intersection of AI-driven efficiency and innovative capital structures makes this an extraordinary moment for early-stage investing. The companies we're meeting aren't raising less because they're thinking smaller. They're raising less because they're building smarter. Early stage investors will need to adapt to this reality, aligning more closer with founders’ new optionality and embracing the fact that they can now be builders not just investors if they have the right skill sets and are properly looking for opportunities to pursue.

I’m currently in discussions with investors about how our next fund is designed to capitalize on this paradigm shift, since I don’t believe the old playbook can be relied upon when the playing field changes. The future belongs to those who understand that in this new era, less capital plus more leverage equals greater outcomes.

Portfolio Highlights

Shield is growing their transaction volumes >80% MoM as they continue to penetrate the wholesale import market.

Dinari announced the completion of their Series A and now has the largest AUM/TVL of any tokenized public US stocks issuer.

Playtron announced the launch of Game Dollar stablecoin ahead of the release of their SuiPlay0X1 handheld later this year.

As always, thanks for reading. If any of this resonates and you want to discuss further, please don’t hesitate to reach out.

-Jake

Jake Dwyer

Founder

Factor Capital

[email protected]