- Factor Capital

- Posts

- Factor Capital Update - Q1 2025

Factor Capital Update - Q1 2025

Navigating the Roller Coaster as tariffs whipsaw markets

Friends of Factor ,

The first quarter of 2025 has certainly lived up to the crypto industry's reputation for volatility – it's been nothing short of a roller coaster. The period began with palpable optimism from many within the industry, fueled by anticipation of favorable regulatory developments in the United States and increasingly visible examples of institutional adoption lending legitimacy to the space. However, the past month served as a stark reminder that the crypto industry doesn't operate in isolation, and broader economic and political currents can significantly influence market sentiment.

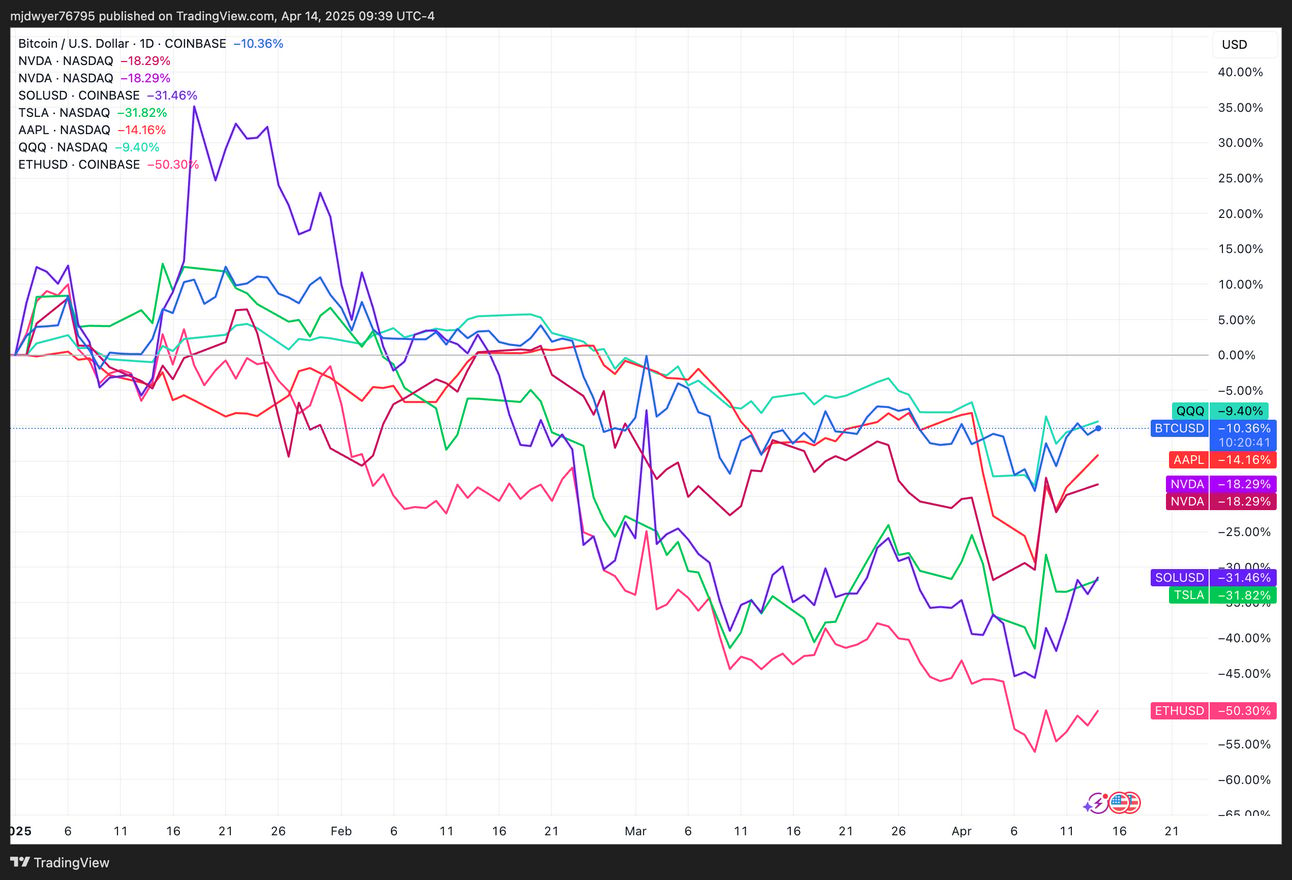

Market Volatility and the Factor Portfolio

Market turbulence has been a defining feature of the latter part of the quarter. While crypto-specific factors are always at play, much of the recent volatility is driven by broader macroeconomic concerns, particularly the uncertainty surrounding the current administration's ongoing trade discussions and their potential impact on global markets. This has created headwinds for risk assets across the board, and digital assets have shown a high correlation. For investors heavily exposed purely to token price fluctuations, the year-to-date performance has been challenging. Major assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have experienced declines of 10%, 50%, and 31% respectively during this period, mirroring the skittishness seen in traditional markets. But despite this decline, BTC has thus far easily outperformed Apple, Tesla, Nvidia on a year to date basis, and is trading on par with Nasdaq 100 (QQQ) which I think is quite notable and speaks to Bitcoin’s growing maturity as a mainstream asset.

Market performance YTD

Fortunately, this market volatility, while notable, has had a minimal direct impact on our portfolio's fundamental value (the knock on effects remain to be seen). Our investment strategy deliberately focuses on businesses with robust, traditional structures designed to deliver tangible value to businesses and customers, irrespective of short-term token market swings. The priority all along has been finding and backing companies solving real-world problems, leveraging blockchain technology to provide a distinct advantage in efficiency, transparency, or capability. For portfolio companies that incorporate a token element, the design ensures a fundamental link between the token's utility and value accretion and the operating company's underlying revenue generation or network activity.

A prime example of how a business might utilize tokens in a way that can still have fundamental value could be our portfolio company, 375ai. They have developed and deployed a sensor network currently capturing valuable real-world data, such as traffic patterns in the Los Angeles metropolitan area via license plate recognition and many other inputs. Customers pay 375ai for access to this data. While 375ai doesn’t have a token today, in the future a situation exists where a portion of these revenues generated by the sensor network is earmarked for potential future buybacks and burning of tokens they may issue. This model would establish a token whose value is underpinned directly by the company's revenue streams, offering a clearer potential floor value and growth trajectory compared to many purely speculative or governance-focused tokens prevalent in the market today. This resilience, derived from real-world utility and revenue, is characteristic of our investment approach.

Today these models have historically been implemented by other decentralized infrastructure (DePIN) networks like Helium (wireless spectrum) and Hivemapper (mapping), and the belief is that further clarity from regulatory moves in the US congress probably makes more of these direct revenue capture mechanisms viable for more businesses with tokens going forward.

Resilient Applications

Despite ongoing market fluctuations, stablecoins and tokenization remain two of the most resilient and impactful use-cases for blockchain technology, with their potential significantly strengthened by anticipated regulatory developments.

Stablecoins: Accelerating Institutional Integration

Stablecoins have demonstrated undeniable product-market fit, underpinning the decentralized finance (DeFi) ecosystem with sustained transaction volumes approaching $600 billion weekly and nearly 30 million global addresses active with stablecoins over the past 30 days. The trajectory from niche adoption to mainstream financial infrastructure is now clearer than ever, driven by growing institutional interest.

Notably, traditional financial institutions like Bank of America and Standard Chartered have entered the stablecoin arena, highlighting a broader trend toward integrating digital currency solutions. The potential enactment of the "Genius Act" currently making its way through Congress could be transformative. This legislation proposes a federal regulatory framework addressing key concerns around reserves, transparency through audits, regulated issuers (potentially including traditional banks), and consumer protections.

Clear regulatory standards would dramatically reduce existing uncertainties, providing a powerful catalyst for broader adoption among both institutions and retail users. This development could elevate stablecoins to an equivalent standing with traditional payment methods, unlocking efficiency benefits such as lower costs, faster settlements, and streamlined international transactions.

Spotlight: CoalaPay’s Strategic Response to Humanitarian Sector Reforms

CoalaPay exemplifies strategic innovation within this evolving context. Recent U.S. government restructuring—especially under the Trump administration, which sharply reduced foreign aid budgets and merged USAID into the State Department—has heightened demand for transparent and cost-effective humanitarian aid solutions. CoalaPay’s blockchain platform directly addresses these pressures by providing enhanced fund traceability, automated compliance, and reduced operational overhead.

The platform’s alignment with evolving priorities—measurable outcomes, transparency, and efficiency—has driven rapid adoption by key humanitarian organizations, including the Norwegian and Danish Refugee Councils. By turning sector challenges into growth opportunities, CoalaPay demonstrates the practical value of blockchain infrastructure.

Tokenization: Institutional Momentum and Regulatory Clarity

Tokenization, the digitization of real-world assets on blockchain, is rapidly becoming integral to financial market innovation. Institutions increasingly recognize tokenization’s potential to improve market efficiency, asset management, and liquidity through smart contracts and automated compliance.

Institutional adoption is gaining momentum: BlackRock (BUIDL fund), Hamilton Lane, and Franklin Templeton now actively use tokenization for fund management, while fintech platforms such as Robinhood explore tokenized equities for seamless, 24/7 trading. Such examples underscore tokenization's role in reshaping market operations and enhancing traditional asset management practices.

However, significant growth hinges on forthcoming regulatory developments. Following the anticipated passage of stablecoin legislation, attention is expected to shift toward a "Market Structure" bill. This legislation would clarify regulatory jurisdictions—distinguishing securities from commodities, delineating roles for the SEC and CFTC—and establish clear rules for exchanges, brokers, and custodians.

Clear, precise regulation would significantly de-risk the broader digital assets sector, fostering trust and facilitating integration with legacy financial systems. Such clarity would attract more institutional participants, ultimately driving substantial market expansion.

Looking Ahead: Legislative Catalysts and Sector Maturation

Navigating current volatility requires patience, yet the ongoing maturation of stablecoin and tokenization frameworks—potentially expedited by imminent legislative clarity—promises substantial long-term opportunities. Clearly defined regulatory parameters will reduce market uncertainty, stimulate institutional adoption, and accelerate the growth of compliant, innovation-driven businesses central to the next era of finance.

Crypto and AI Similarities as Commodity Inputs

The benefits of AI are already apparent, accelerating product development roadmaps and reducing operational costs for many portfolio companies. Drawing parallels to the early days of AI adoption – like my experience helping to start HyperScience 10 years ago, which focused on AI for document processing – we see similar patterns. Solutions that were once complex and proprietary are becoming more widely accessible at very low costs. Tools built using state-of-the-art Large Language Models (LLMs) now allow entrepreneurs to tackle complex process automation tasks at minimal cost. This month has another onslaught of model enhancements:

Anthropic’s Claude getting access to web search

OpenAI’s latest image generation tool in GPT-4o took the internet by storm

Google’s Gemini 2.5 Pro further reinforced their ability to be leaders at the edge

Meta released Llama 4, which is now arguably the best open-source model available, accessible in their suite of products

This train is not slowing down and it means that these capabilities are just becoming more widely distributed to more users. There becomes an exciting opportunity where businesses take advantage of these tools as well as the capabilities of freely accessible blockchain standards to produce innovative results.

Our portfolio company Jasmine, for example, recently launched an AI-powered platform to streamline Renewable Energy Certificate (REC) management for homeowners and businesses. Historically, managing RECs has been a cumbersome process designed for large utilities. Jasmine's AI automates registration, data validation, and REC sales, making it effortless for potentially millions of solar owners to access income they were previously missing. Jasmine's platform, the first of its kind for residential and commercial owners, ensures that solar owners, regardless of scale, get paid quickly and effortlessly through transparent REC sales and payouts. This application of fine-tuned LLMs and custom tools accelerates REC onboarding, showcasing how smart businesses leverage AI internally to enhance efficiency and better deploy solutions for external customers.

This convergence signifies a powerful trend: AI and crypto are commoditizing complex systems. With AI we are seeing commoditized access to advanced intelligence and with crypto we see commoditized access to advanced financial tools and market infrastructure.

I wrote about this at length this past month in my post “A Million New Founders”. But technologies that were once expensive and proprietary are becoming widely accessible and affordable, enabling anyone to build innovative solutions. We expect this dual trend to be transformative over the next several years as these systems grow more powerful and feature-rich. As crypto adoption proliferates, particularly through user-friendly stablecoins potentially onboarding millions unknowingly, it creates an even more compelling foundation for development.

Market Dynamics: Push vs. Pull

One critical differentiator between the crypto and AI markets today lies in their demand dynamics. AI currently benefits from strong market "pull," where companies actively seek out solutions, creating inbound demand for suppliers and compelling nearly every business to define its AI strategy. Tangible, accessible applications like ChatGPT and Perplexity provide immediate value and a "wow" factor, making the opportunities for operational leverage clear and widely recognized.

In contrast, crypto largely operates in a "push" phase, requiring more proactive sales and marketing efforts to drive adoption. Despite being operational for over a decade, crypto is significantly less mature in its adoption cycle compared to AI (whose theoretical underpinnings trace back over 75 years). As mentioned, attempts to commercialize AI 10+ years ago faced a similar "push" dynamic; corporations were intrigued but uncertain how to apply it effectively, lacking internal expertise and facing speculative costs – a situation analogous to crypto today.

While clear crypto value propositions exist (especially in stablecoins and tokenization, offering benefits like reduced payment costs and streamlined operations), broad adoption requires more effort compared to the perceived potential and urgency surrounding AI. We find businesses willing to engage where gains are well-defined and risks seem low, leading to rapid growth in specific niches. However, there isn't the same universal pressure seen with AI; few companies mandate crypto exploration like Shopify recently did - requiring documented justification for any new hires that a role cannot be filled by AI before approving a new requisition.

Strategic Focus

The prevailing "push" dynamic within the crypto market directly informs and reinforces our strategic investment focus. Given that widespread adoption isn't yet being pulled by universal market demand as seen with AI, it's crucial to invest in companies where the path to adoption is clear and compelling on its own merits. Therefore, we concentrate on businesses targeting well-defined market segments where the value proposition offered by crypto or blockchain technology is unambiguous and solves a significant, identifiable pain point.

We seek out ventures whose solutions provide demonstrable improvements over existing alternatives – whether through significant cost reductions (like lowering cross-border payment fees), enhanced efficiency (automating complex back-office processes), increased transparency (tracking aid distribution), or enabling entirely new capabilities (fractional ownership of unique assets). The goal is to find opportunities where the benefits are so clear and substantial that adoption becomes a logical, almost inevitable choice for the target customer, overcoming any inertia or perceived risks associated with embracing new technology.

This focus on tangible, near-term value helps mitigate the challenges of operating in a market still reliant on "pushing" its innovations. It is easier to push when you’re offering opportunities for businesses to lower costs, increase efficiencies and reduce complexity of their operations. This is especially true in a highly uncertain macro market where we see the Nasdaq trading at similar volatility to meme coins. Down markets are often a catalyst for new company formation and it should be a busy time for new startup formation over the next several months.

Thanks as always for reading,

Jake Dwyer

Founder, Factor Capital