- Factor Capital

- Posts

- Factor Capital Update - December 2025

Factor Capital Update - December 2025

This month, I felt it was important to revisit the current state of markets in the context of the sharp decline we’ve seen over the past few weeks in both crypto and public tech stocks. We are witnessing yet another example where the last decade of crypto behavior and capital markets can serve as a guide for what is unfolding in the AI landscape.

When a “Seed Round” Becomes an Infrastructure Round

Last week, Unconventional AI announced a $475M seed round at a $4.5B valuation, co-led by Lightspeed and Andreessen Horowitz. This feels like a defining moment for the current vintage of venture capital. The cap table reads like a who’s-who of elite venture investors, including Sequoia, Lux, DCVC, and Jeff Bezos. But it’s notable that this type of financing is being led by venture firms at all, rather than the Apollo’s or Blackstone’s of the world. Let me explain.

On the merits, the bet is easy to understand. Unconventional AI’s CEO, Naveen Rao, has earned the right to swing big. He previously sold Nervana to Intel and MosaicML to Databricks, the latter widely reported as a $1.3B deal. Unconventional’s pitch is not “yet another wrapper”. It is a full-stack attempt to build a new, dramatically more energy-efficient compute substrate for AI.

So this isn’t a critique of the bet. It’s a critique of the label.

Calling a $475M first check “seed-stage venture capital” is like calling a hyperscaler capex plan “an early prototype.” It’s not wrong in a legal sense, but it is misleading in an economic sense. This is infrastructure-scale investing. The capital is being deployed not to explore an uncertain product thesis, but to buy time, talent, supply chain, and industrial execution.

That semantic slippage matters, because it suggests a lot of VCs might be playing the wrong game.

The Capital Stack Is Eating Its Own Tail

Traditional venture funds are built around power laws, where a few outliers return the fund. But infrastructure-style rounds often look more like scaled industrial outcomes than venture-shaped asymmetry.

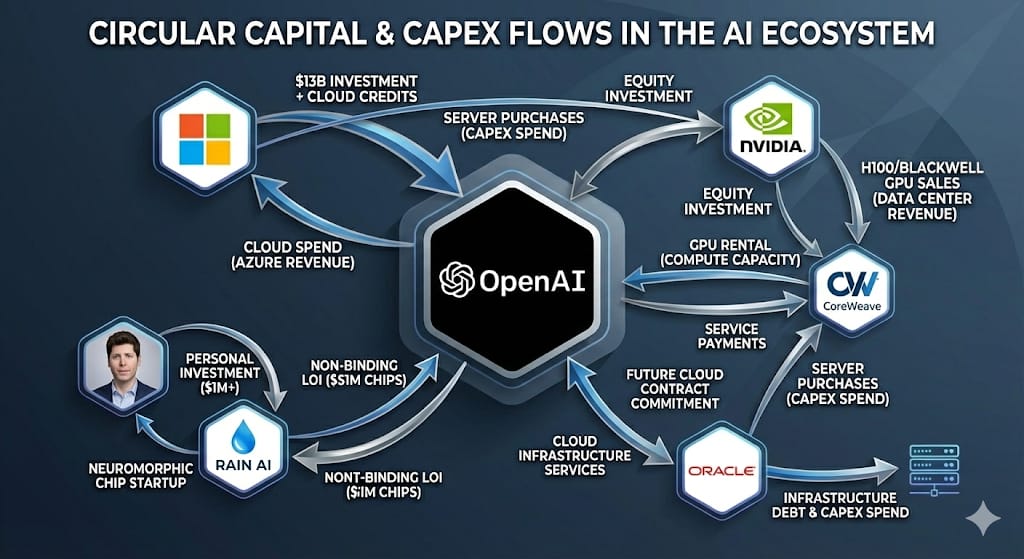

And beyond labels, another weird part of this era is that the money is increasingly circular. Companies invest in other companies, who then use that money to buy compute, chips, and cloud from the same ecosystem that financed them. Sometimes the “customer” and the “capital provider” are effectively part of the same machine. This cycle has permitted OpenAI to line up $1.4T in capital commitments for future infrastructure buildout.

Gemini 3 Nano Banana Pro at work

Zoom out and it gets stranger. OpenAI is posting very real revenue scale, supposedly on pace for a $20B annual run rate by the end of this year, while simultaneously maintaining massive, long-dated commitments to the infrastructure layer. The financing instruments still say “venture,” but the underlying activity looks like an industrial build-out.

The “Code Red” Moment

This intensity stems from a simple truth: everyone feels they are fighting over something generational.

Last month, Google’s Gemini 3 launch was a credibility event, as impactful as the “DeepSeek” moment earlier this year. With market-leading benchmarks, the industry treated it as a shot across the bow. OpenAI’s response tells you everything about the stakes. Within a week, Sam Altman issued an internal “code red,” accelerating the release of GPT-5.2 in direct response.

While Sam publicly downplayed the impact on metrics, third-party data suggests the race is tightening. Gemini’s user base grew materially faster than ChatGPT’s from August to November 2025. This is what competition looks like when the prize is the default interface to knowledge work.

The Crypto Warning: When "Winning" Doesn't Pump the Bags

This is where the environment becomes dangerous for startups. There is likely a large population of companies being funded today that are great ideas, but that will end up as the failed Version 1 of a winning concept in the same way Webvan’s $800M in invested capital in the Dot Com crash went towards warehouses and logistics infrastructure that was soon commoditized by the iPhone and capitalized on by Uber and Doordash.

We’ve seen this movie before in crypto, and the current state of that market offers a stark warning about the difference between adoption and returns.

As we sit here at the end of 2025, many claim crypto is in its healthiest place ever. Regulatory clarity is strong and mainstream adoption is undeniably happening. Yet the community is in crisis as markets have collapsed more than 30% from the all-time highs of two months ago.

Why the disconnect? Because “winning” looks different than “investing.” The original crypto crowd, enamored with ideals of decentralization and self-sovereignty, is watching the victory go to the very centralized authorities they sought to replace. The adoption is coming from big banks and fintech incumbents like Robinhood and Coinbase.

Crucially, this mainstream activity does nothing to drive up token prices. Much of the volume is simply low-cost usage of blockspace for tokenization, taking advantage of commodity technology. The casino is losing, the banks are winning, and the technology is finally working as intended: as cheap plumbing.

The V1 Trap

This dynamic is visible in specific verticals, too. Prediction markets are currently the biggest story in the sector. Kalshi just raised $1B at $11B valuation, doubling value in under two months, and ICE (the NYSE’s parent) also put $2B into Polymarket at a reported $9B valuation.

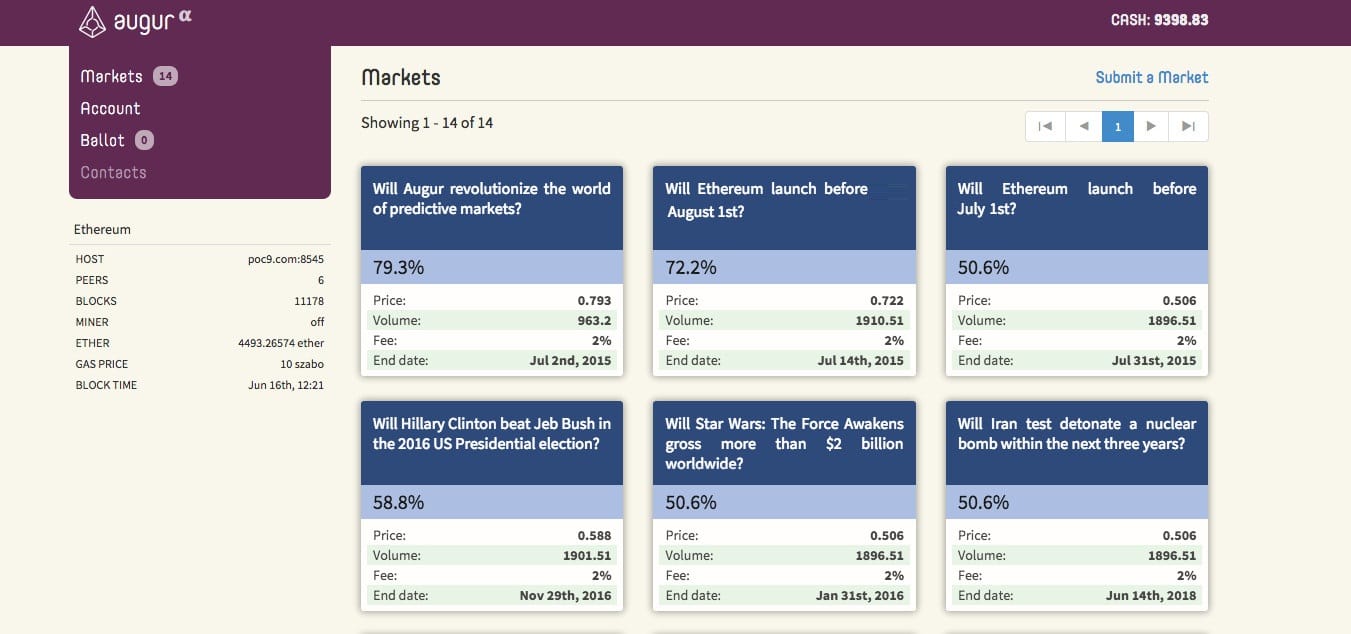

Augur - the V1

But rewind ten years. Companies like Augur were the "Version 1." They had the right idea, but they were too early. They couldn't scale because of the fragility of the crypto infrastructure at the time. It took a decade of overinvestment to harden the rails before companies like Kalshi and Polymarket could capitalize on the concept.

AI applications face the same risk. If your model advantage is thin and your burn is driven by expensive inference, you may get leapfrogged by a "Version 2" entrant that launches three years from now into a world where the same capability is dramatically cheaper and the market has already been "educated" by your spend.

The Browser Wars and The Real Estate Endgame

Fred Wilson of USV recently framed the LLM wars as a redux of the browser wars. Netscape vs. Microsoft mattered, but the real compounding winner was the layer above it: search, where Google piggybacked on the browser and broadband infrastructure to become among the best cash machines in the history of business. If chatbots and base models become table stakes, the enduring winners will be the distribution layers that turn raw capability into a durable business.

Ultimately, this cycle will likely rhyme with commercial real estate. When a city overbuilds apartments during a boom, the buildings don’t disappear when financing tightens. The asset base remains.

Even if today’s capital stack overextends, the data centers and chips will still exist. Eventually, the "glut" leads to below-build-cost pricing. The winners of the AI era might not be the people who financed the build-out, but the application companies that arrive later, when “intelligence” has become a cheap, deflationary input, just as tokenization has become for the banks.

Thanks as always for reading.

Until 2026,

Jake Dwyer

Founder

Factor Capital